Trade - Etherex Exchange

Etherex is Linea's new next-gen MetaDEX designed on Ramses v3 engine to support concentrated liquidity, efficient swaps, and sends 100% of liquidity rewards to LPs.

Etherex is Linea's new next-gen MetaDEX designed on Ramses v3 engine to support concentrated liquidity, efficient swaps, and sends 100% of liquidity rewards to LPs. Etherex was developed by a team of experienced developers to deliver advanced DeFi infrastructure.

Etherex has emerged as a powerhouse, redefining how users interact with on-chain trading. As a premier Etherex DEX built on the Linea zkEVM Layer-2 network, Etherex was designed to offer efficient, on-chain spot trading of ETH and stablecoins. Launched in July 2025, Etherex Finance was developed through rigorous technical progress and collaboration among leading developers, leveraging advanced technology to foster deep liquidity and sustainable DeFi. Etherex provides live market data and trading metrics in USD, including market capitalization. This article explores the intricate mechanisms of Etherex, from its unique Etherex REX tokenomics to its position within the broader crypto landscape, including comparisons to platforms like Polymarket.

The Etherex Exchange and Linea zkEVM Integration

Etherex is a decentralized exchange (DEX) that stands out by leveraging Linea's Layer 2 infrastructure. This integration results in low gas fees and rapid transaction confirmations, solving major scalability issues found on the main chain. By being built on Linea, Etherex ensures that trading is accessible and cost-effective for all users.

The platform is built on the Ramses v3 engine, an upgraded version of Uniswap v3. This engine enhances liquidity efficiency and yield sustainability. Unlike traditional automated market makers, Etherex integrates concentrated liquidity, transparent governance, and full on-chain incentive alignment. The goal is to consolidate ETH and stablecoin liquidity within the Ethereum ecosystem, making Etherex Linea a hub for assets.

Etherex REX: The Tri-Token System and x(3,3) Tokenomics

At the heart of the Etherex crypto ecosystem is the REX token. The REX token was launched on August 6, 2025, and initially had a decaying fee mechanism to prevent exploitation by bots. The REX token is Etherex's native token, which powers a flywheel of rewards. Etherex employs an x(3,3) tokenomics model, which maximizes staking incentives and creates compounding opportunities for users.

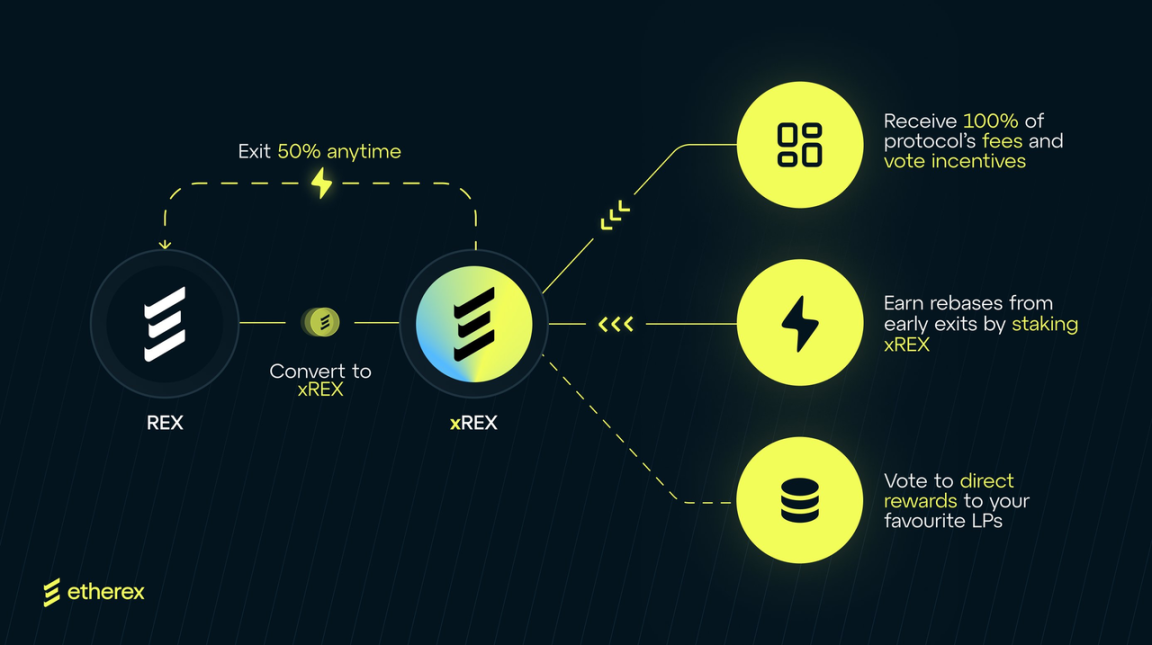

To manage these incentives effectively, Etherex uses a tri-token system consisting of REX, xREX, and REX33.

REX

Used to gain entry to the Etherex system; it can be freely bought and sold.

xREX

The locked version of REX. Staking REX into xREX gives users governance rights and a share of all trading fees. It also allows holders to receive emissions and part of penalties paid by users.

REX33

A liquid staking version of xREX that allows for auto-compounding and yield-capture capabilities.

This robust model ensures that Etherex's emissions are liquid from day one, unlike traditional DEXs that require tokens to be locked for years before users can realize value.

Concentrated Liquidity and Etherex DEX Rewards

Etherex excels in concentrated liquidity optimization, allowing LPs (Liquidity Providers) to set specific price ranges for their assets. By doing so, they foster deep liquidity around current market prices. Liquidity providers on Etherex earn rewards based on the activity of the pools they participate in.

The Etherex Exchange employs a dynamic fee adjustment system. Trading fees on Etherex range from 0.0088% to 1.5% and automatically adjust based on market volatility and pool activity. This system rewards liquidity providers based on demand and pool performance. Remarkably, Etherex distributes 100% of trading fees to xREX governance token holders and 100% of liquidity rewards to liquidity providers, with no cuts to insiders or the team.

To simplify the process, Etherex offers the "Magic Max" tool, which enables users to provide liquidity with only one asset by automatically splitting it into two required assets. Users can earn annual percentage returns (APRs) that vary based on their choosen liquidity strategies.

Etherex Crypto Governance vs. Platforms like Polymarket

While platforms like Polymarket focus on prediction markets, Etherex focuses on tangible asset exchange and governance. Users can stake xREX to gain governance rights and a share of trading fees on Etherex. This MetaDEX model ensures that every fee, emission, and penalty stays within the ecosystem, strengthening liquidity pools and supporting governance.

Etherex enables permissionless, peer-to-peer trading via smart contracts without a central authority. This level of autonomy is what makes Etherex Finance distinct from centralized entities. Etherex is a community-driven project that encourages user participation, allowing instant access to rewards and giving flexibility without compromising the ecosystem's health.

User Interface: Navigating the Etherex Experience

Navigating a decentralized exchange should be as seamless as it is secure, and Etherex delivers on both fronts with a user interface designed to empower every participant. Built on the robust Linea chain and leveraging the advanced Ramses v3 technology, Etherex's interface is crafted to foster deep liquidity and make accessing concentrated liquidity pools straightforward for all users.

Upon entering the platform, users are greeted by a dynamic dashboard that provides a comprehensive snapshot of the exchange's current state. Here, users can instantly view key metrics such as market capitalization, real-time trading fees, and the latest liquidity rewards available. The intuitive layout allows users to effortlessly switch between trading, managing liquidity, and participating in governance, ensuring that every aspect of the Etherex experience is just a click away.

Etherex allows users to rebalance their liquidity positions at any time to continue earning rewards.

A standout feature of the Etherex interface is the ability for users to choose from a variety of liquidity pools, each designed with unique incentives and fee structures. Whether you're a seasoned liquidity provider or new to DeFi, the platform makes it easy to compare pools, assess potential rewards, and select the strategy that best aligns with your goals. The interface transparently displays all associated fees and rewards, so users can make informed decisions and maximize their returns.

Etherex also places a strong emphasis on education and support. The platform offers a comprehensive guide, complete with links to tutorials, FAQs, and other resources, making it accessible for both newcomers and experienced traders. This commitment to user empowerment is further reflected in the platform's governance dashboard, where users can actively participate in decision-making and help shape the future of the exchange.

Security and trust are at the core of the Etherex experience. The platform employs a trustless smart contract system, ensuring that all trades and liquidity operations occur transparently and securely. Rigorous audits by leading firms reinforce the reliability of the technology, giving users peace of mind as they engage with the exchange.

Unlike many other DEXs, Etherex is designed to be both powerful and approachable, combining cutting-edge technology with a user-centric approach. As the platform continues to evolve, its focus on rewarding active participants and fostering deep liquidity positions Etherex as a leading choice for anyone seeking a secure, efficient, and rewarding decentralized trading experience.

Security and the Future of Etherex Decentralized Exchange

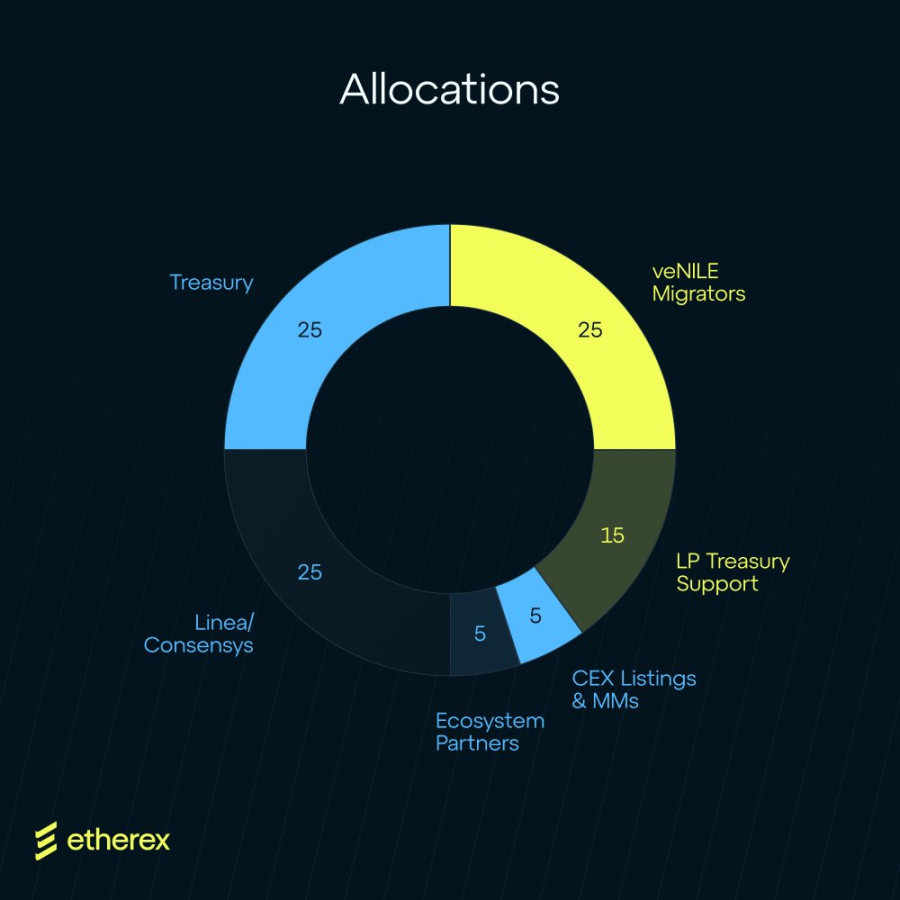

Security is paramount in the crypto space. Etherex has undergone audits by reputable firms like Consensys Diligence, Spearbit, and Code4rena for enhanced security. Additionally, Etherex is supported by ConsenSys and NILE, adding a layer of trust to the network.

For those interested in managing their portfolio, users can store REX and other tokens securely in Atomic Wallet while participating in Etherex.

In conclusion, Etherex is rewarding active participants through its sophisticated Etherex Linea infrastructure. With its x(3,3) model, Ramses v3 engine, and commitment to foster deep liquidity, Etherex is poised to capture significant market capitalization. Whether you are looking to share in trading fees, provide liquidity, or engage in governance, Etherex offers a comprehensive Etherex DEX experience that rivals any exchange in the industry. Check the links, verify the contracts, and read the docs to learn more about this opportunity.